View funding and business loans tailored to you

We’ll run pre-eligibility checks to show you credit options you could be eligible for. Perfect for boosting cash flow or getting your business idea off the ground.

Open banking is an easy way to connect your bank account to apps and platforms that can help you do more with your money.

It’s safe and secure, fully regulated, trusted by over 6 million people in the UK, and you can stop sharing any time you want to.

Connect your existing account to Tide for access to powerful accounting and invoicing tools, cash flow analysis, and business loans.

Connecting your bank account to the Tide platform gives you access to features and products that reduce your money admin – and boost your bottom line.

So you can enjoy the best of Tide, without having to switch your current account.

We’ll run pre-eligibility checks to show you credit options you could be eligible for. Perfect for boosting cash flow or getting your business idea off the ground.

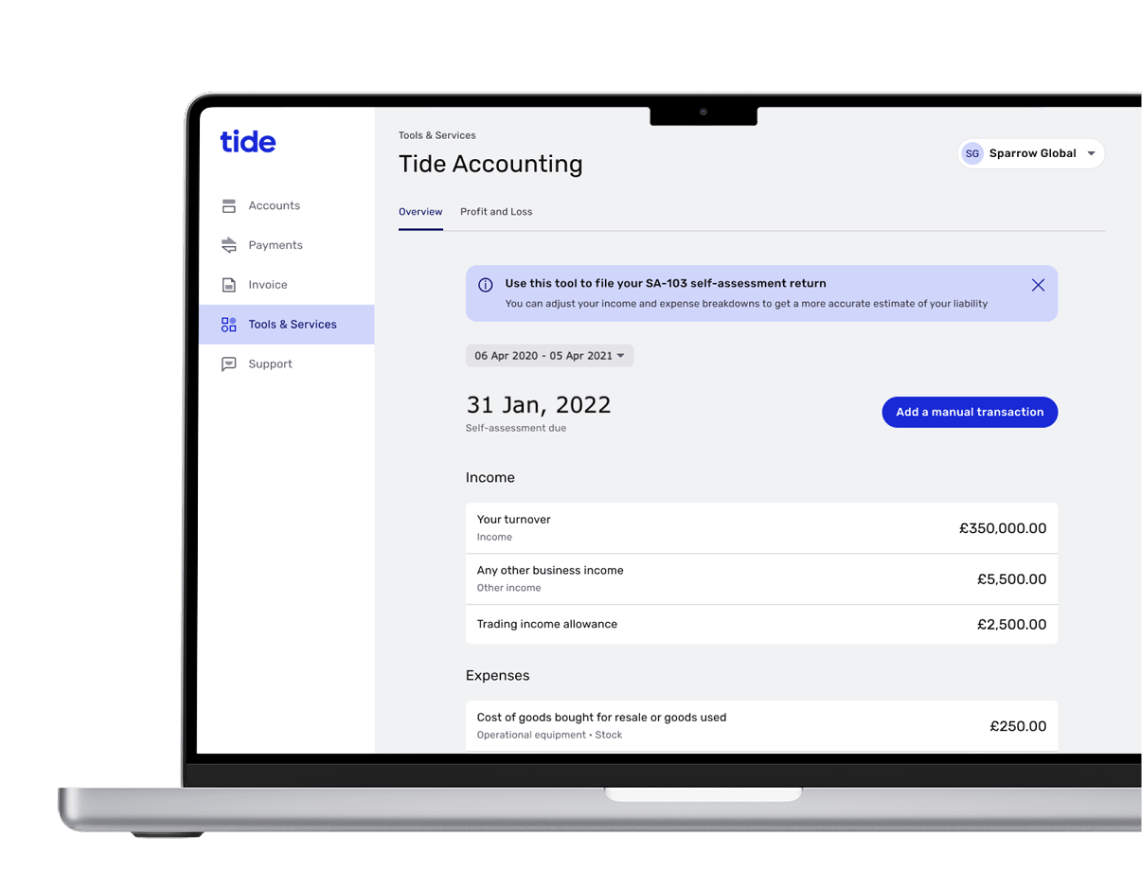

Self Assessment calculations, VAT returns, profit and loss reports, balance sheets… handle all your small business accounting needs with our built-in software. Free until April 2023.

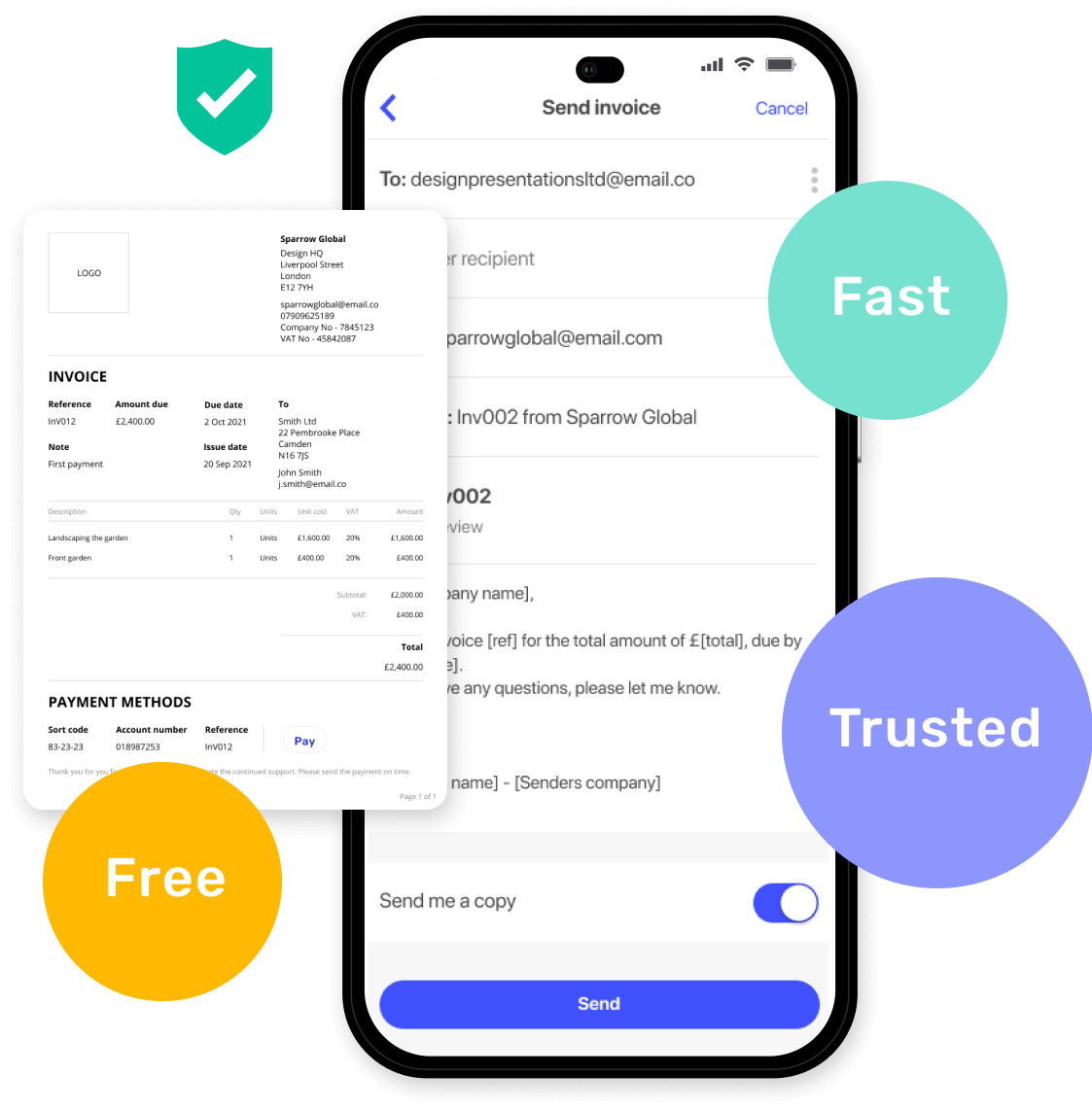

Create and send personalised invoices. We’ll match incoming payments to outstanding invoices, so you know who has paid – and who to chase. All for free.

Get automated cash flow forecasts for up to 30 days ahead, advance warning of any problems, and tailored actions to keep your business finances healthy.

You can connect your bank account to Tide securely in just 5 minutes:

Enter your email address and mobile phone number

Read and accept our open banking terms and conditions

Select the bank that provides the account you’re connecting

Authenticate the connection via your bank’s app or website

Tell us some basic information about you and your business. And that's it!

Yes, but you can only do this during your initial sign-up. When you click Connect to Tide, you’ll enter our sign-up process. Here, you can choose to connect more than one bank account – but you won’t be able to add any more after this.

No. But we understand this would be a useful feature for Tide members, so it’s currently in development and we hope to make it available in early 2023.

No. Every 90 days, we’ll ask you to re-authenticate the connection between Tide and your business bank account.

If you don’t do this, the connection will expire and you will no longer be able to access the Tide platform with that bank account.

We only use your data for the reason you gave us access to it. When you connect to Tide, you authorise us to access your current account for the purposes of using the Tide platform and accessing additional services – and that’s all we do.

We don’t (and can’t) access any other data about your relationship with your bank, for example details about credit cards, mortgages, or any other banking products you have.

Open banking works via a secure application programming interface (API), which is a safe and commonly-used method for two computer programs to share information.

If you’re already using your bank’s mobile app or online banking facility, open banking is just as safe as that.

The open banking system has strict standards and regulations about which providers can participate, and the security of the technology they must use.

Find answers to all our most frequently asked questions and how to contact our Member Support team.