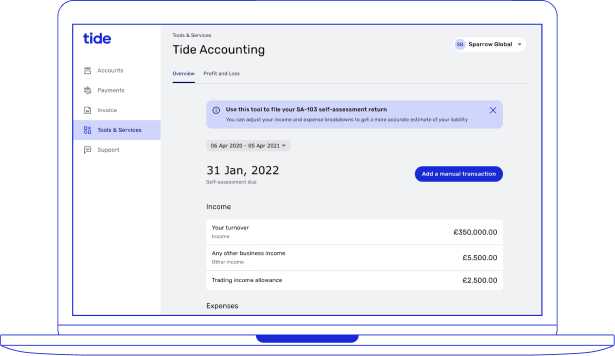

Tide Accounting helps you tackle two big tasks:

- VAT – sole traders and limited companies can use Tide Accounting to complete and submit their VAT returns (as long as they use the cash accounting scheme for VAT)

- Self Assessment – sole traders can use Tide Accounting to estimate their income tax liability (provided they’re not VAT-registered)